Every business exists as long as it has customers.

But what if these customers decide to part ways due to inefficient support processes, defective products, or poor engagement?

From startups to Fortune 100 companies, customer churn remains a tough nut to crack. Even small month-on-month increments in customer churn rate can raise serious concerns about a business’s long-term sustainability.

So, how do you stop churn and retain your customers for a lifetime? This blog will reveal all the answers. We will understand the meaning of churn, how to calculate it, its common types, and how your business can prevent churning customers for long-term success.

What Is Customer Churn?

Customer churn, also known as customer attrition, refers to the phenomenon where customers stop purchasing or interacting with a business. High customer churn can indicate inefficiencies in products or services. Customer churn doesn’t happen overnight; it begins with dissatisfaction with your offerings. There are several tell-tale signs of customer churn, including:

- Inactive customer registrations with no new purchases

- Increased number of unsubscribes

- Reduced engagement with marketing emails, newsletters, or promotions

- Negative feedback and an increase in customer complaints

- Lower Net Promoter Scores (NPS), indicating reduced customer satisfaction and loyalty

- Increased customer service inquiries about cancellations or refunds

Most businesses use a robust help desk ticketing system to centralize complaints and automate support, reducing the number of unhappy and churning customers. Watch this short video to learn more about how a ticketing system works:

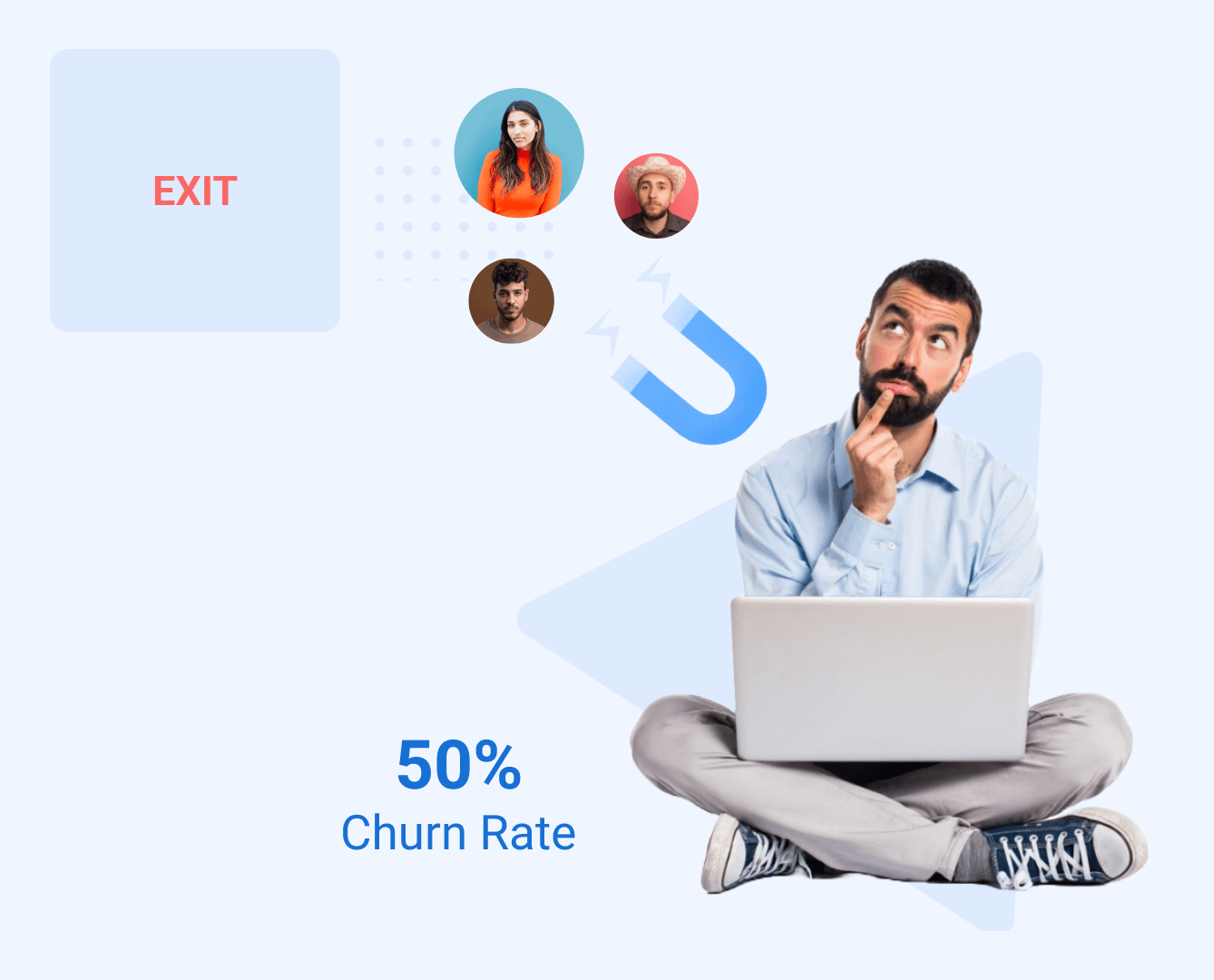

Understanding the Customer Churn Rate

Customer churn rate is the percentage of customers who stop using a company’s product or service over a specific period. It is a critical metric for businesses, especially those with subscription models, as it directly reflects customer retention and satisfaction.

A high churn rate often indicates dissatisfaction, poor product-market fit, or strong competition, while a low churn rate signals customer loyalty and engagement. Monitoring and reducing churn is essential for sustainable growth, as retaining existing customers is typically more cost-effective than acquiring new ones.

What Are the Types of Customer Churn?

Over the years, customer churn has become a critical metric for businesses across the globe. Understanding the different types of customer churn can help develop strategies to reduce it. Here are the primary types of customer churn:

1. Voluntary Churn

This occurs when customers actively choose to stop using a product or service. It can happen for various reasons, such as dissatisfaction with the product, better offers from competitors, or changes in customer needs and preferences.

2. Involuntary Churn

This churn happens without the customer’s intent, often due to circumstances beyond their control. It can be due to failed payment methods, expired credit cards, or other technical issues.

3. Contractual Churn

Contractual churn occurs in subscription-based businesses where customers have signed up for a fixed period. Churn is measured when these customers do not renew their contracts at the end of the subscription period.

4. Deliberate Churn

This churn happens when a company ends its relationship with a customer. This can occur if the customer is not profitable, engages in abusive behavior, or violates terms of service.

5. Latent Churn

Latent churn refers to customers who have not formally canceled but have stopped using the service or product. These customers might still be paying, but their inactivity signals a high risk of eventual churn.

6. Competitor-Driven Churn

This occurs when customers leave because they find a better product, service, or price with a competitor. Competitor-driven churn is often influenced by the competitive landscape and market positioning.

7. Service-Level Churn

Service-level churn happens when customers leave due to dissatisfaction with the level of service provided. This can include slow response times, inadequate support, or unmet service expectations.

8. Price-Sensitive Churn

Price-sensitive churn occurs when customers leave because they perceive the price of the product or service to be too high relative to its value. Discounts or more affordable competitors can drive this type of churn.

What Are the Advantages and Disadvantages of the Churn Rate?

No matter which customer churn model you follow, there are certain advantages and disadvantages you should consider. Let’s explore them in detail.

Advantages of the Churn Rate

1. Identifies Customer Retention Issues

The churn rate acts as an early warning system for potential problems in retaining customers. By monitoring this metric, businesses can take corrective actions, such as enhancing product quality or improving customer service, to reduce churn.

2. Measures Business Health

A low churn rate often signals a strong connection between the business and its customers. It shows stability in the customer base and revenue, making it a critical metric to assess the overall health and sustainability of a business.

3. Aids in Strategic Planning

Knowing how many customers are leaving helps businesses refine their growth strategies. They can allocate budgets effectively for retention programs, marketing campaigns, and customer support initiatives to boost loyalty and reduce churn rates.

Disadvantages of the Churn Rate

1. Does Not Reveal Root Causes

While the churn rate tells how many customers are leaving, it doesn’t explain the reasons behind their departure. Without complementary tools like surveys or analytics, businesses are left guessing why churn occurs.

2. Overemphasis Can Be Misleading

Over-focusing on churn rate may divert attention from other critical metrics, such as customer acquisition or lifetime value. A slightly high churn rate could be acceptable if the business is acquiring customers at a faster rate.

3. Challenging to Interpret in Isolation

The ideal churn rate varies significantly across industries and business models. Comparing it without proper benchmarks can lead to inaccurate conclusions, making it less actionable unless considered alongside other performance indicators.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

How to Calculate Customer Churn

Customer churn rate is a crucial metric that measures the percentage of customers who stop doing business with a company within a specific timeframe.

Here is the churn rate formula:

Churn rate = (Number of Customers Lost / Total Number of Customers at the Start of the Period) x 100

Calculation Steps:

- Define your time period: This could be monthly, quarterly, or annually

- Count the number of customers at the beginning of the period

- Count the number of customers who churned during the period

Example of Churn Rate:

Let’s say you own a subscription-based streaming service, StreamFlix, and you want to calculate the churn rate for the month of October.

- Initial customers at the start of October: 1,000

- Customers lost during October: 50

Here, churn rate = (50/1000) x 100 = 5%

This means 5% of your customer base left during October. However, if this churn rate persists, it could indicate potential issues with customer satisfaction, pricing, or the content offered.

What Does a High Customer Churn Rate Mean?

A high churn rate means that a large percentage of your customers are leaving or canceling their subscriptions within a given period. It’s a critical metric for SaaS businesses because it directly impacts revenue and growth.

Here’s a breakdown of what a high churn rate signifies:

- Lost Revenue: Churning customers often leads to a loss of recurring revenue. A high churn rate means your business is bleeding money, making it difficult to achieve profitability and sustainability.

- Customer Dissatisfaction: High churn is often a strong indicator that customers are unhappy with your product or service. This could be due to various reasons, such as poor onboarding, lack of features, usability issues, inadequate customer support, or pricing concerns.

- Ineffective Customer Acquisition: If you’re acquiring many customers but losing them at a high rate, it indicates that your acquisition efforts are not attracting the right kind of customers or that your product isn’t meeting their expectations.

- Competitive Pressure: A high churn rate could suggest that your competitors are offering better solutions, pricing, or customer experience, luring your customers away.

How to Reduce Customer Churn – 8 Expert Strategies

Reducing customer churn is critical for maintaining a healthy, growing business. By implementing targeted strategies, you can improve customer retention and build stronger, more loyal customer relationships. Here are eight expert strategies to help you achieve this:

1. Understand Who Your Your Customers Are

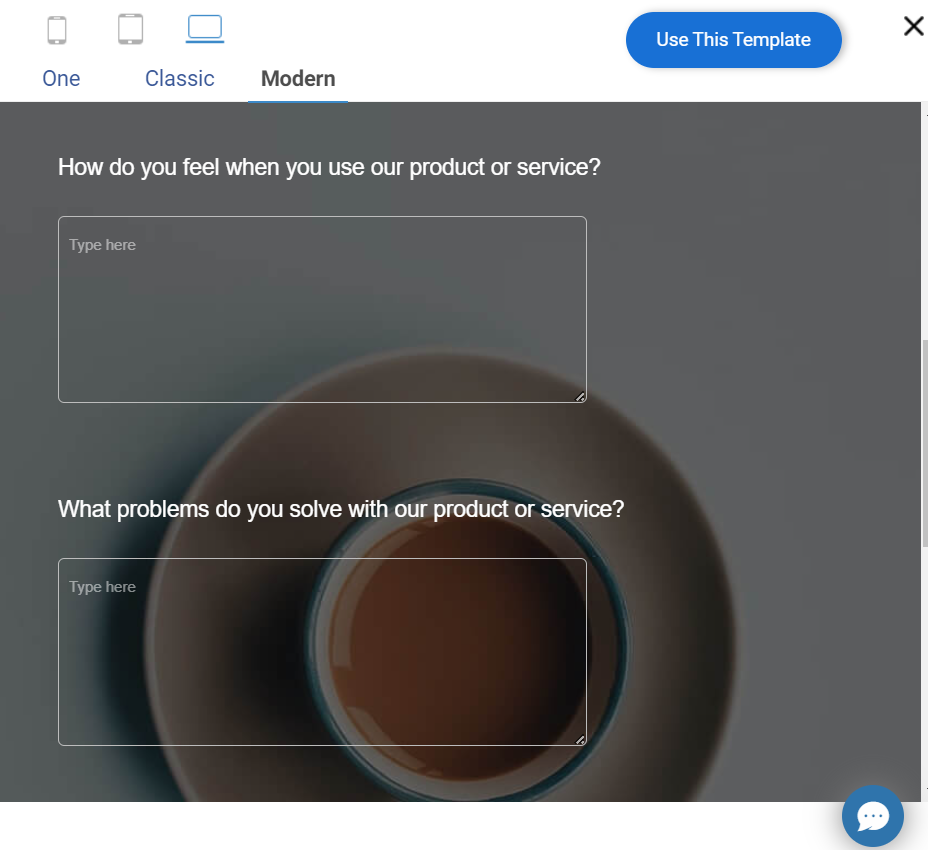

A comprehensive understanding of the customer base is foundational to reducing churn. Conducting in-depth analyses of customer behavior, preferences, and pain points can provide valuable insights into customer satisfaction and loyalty. This knowledge helps tailor strategies that precisely address specific customer needs, enhancing their overall experience and fostering long-term relationships. Here is how you can get a better grip on your customer base:

- Segment Your Audience: Divide customers into groups based on demographics, behavior, or value. This helps tailor strategies to specific segments.

- Map the Customer Journey: Visualize the customer experience to identify pain points and areas for improvement.

- Take Customer Feedback: Actively seek and analyze customer feedback to understand their needs and concerns.

2. Onboard Customers Effectively

A well-executed onboarding process is crucial for setting a positive foundation for strong customer relations. By providing a seamless and engaging onboarding experience, businesses can increase customer satisfaction and reduce the likelihood of early churn.

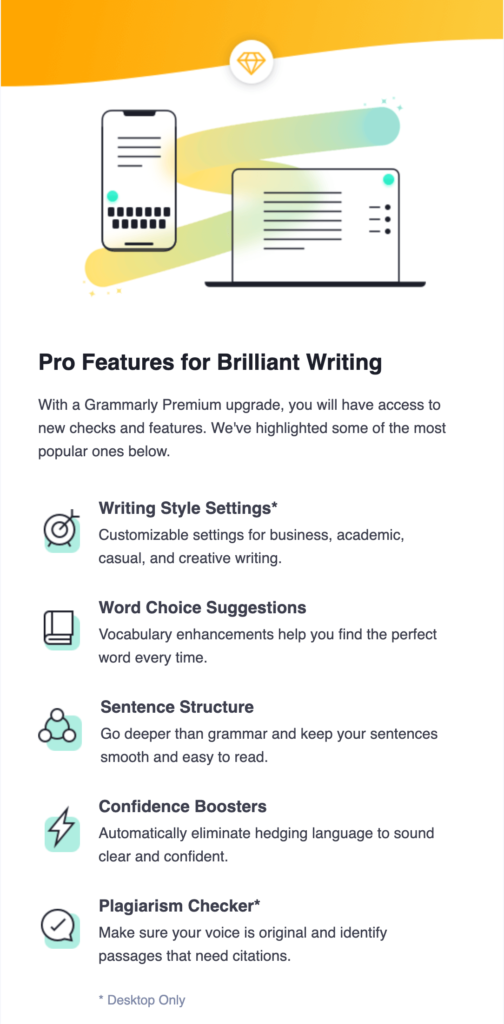

- Clear Value Proposition: Communicate the product or service’s benefits clearly from the outset. For example, in one of its onboarding emails, Grammarly does a great job of highlighting its new features and how they can benefit the user.

Image Source: Fluentcrm.com

- Interactive Onboarding: Engage new customers with interactive tutorials, guides, or demos.

- Personalized Experiences: Tailor onboarding to individual customer needs and preferences.

3. Automate & Improve Service With Help Desk Software

One of the top reasons for customer churn is poor service. Implementing help desk software is essential for automating and enhancing customer service processes. The more customers get timely solutions and assistance, the less likely they are to leave your business. Here’s how a help desk system can help improve customer service and prevent churn:

- Efficient Ticket Management: Help desk software allows for the efficient management of customer inquiries and issues by organizing them into tickets. The ticketing system helps prioritize urgent matters and ensures no query goes unanswered.

- Automation of Repetitive Tasks: Agents can automate routine tasks such as ticket routing, escalations, and standard responses. This not only speeds up resolution times but also frees up support agents to handle more complex issues.

- Enhanced Communication Channels: Provide customers multiple ways to contact support, including email, chat, and social media. Help desk software can centralize these interactions, ensuring a consistent and seamless experience across all channels.

4. Continuously Improve Your Product or Service

Continuous product or service improvement is vital for maintaining customer satisfaction and driving retention. By staying ahead of customer needs and expectations, businesses can reduce churn and foster loyalty.

- Practice Customer-Driven Development: Involve customers in product development to ensure your offerings meet their needs and expectations. Gather regular feedback and conduct user testing to align your product with customer preferences.

- Iterative Improvements: Regularly update and enhance your offerings based on customer feedback to keep your product relevant and valuable. This continuous improvement helps address evolving customer needs and resolves any issues promptly.

- Conduct Competitive Analysis: Stay informed about industry trends and competitor offerings to identify gaps and opportunities for improvement. This helps you adapt to market changes and maintain a competitive edge.

5. Offer Flexible Pricing & Contracts

Rigid pricing and contract terms can hinder customer retention. By providing flexible options, businesses can accommodate diverse customer needs and preferences, increasing customer satisfaction and reducing churn.

- Transparent Pricing: Clearly communicate the value of your product or service to help customers understand what they are paying for. Ensure all pricing information is upfront and easy to find to build trust and avoid surprises.

- Flexible Payment Options: Provide various payment methods to accommodate customer preferences, making transactions more convenient and accessible. This flexibility can enhance the customer experience and reduce barriers to purchase.

- Contract Options: Offer both short-term and long-term contracts to meet customer needs, providing flexibility for those who prefer commitment-free options and stability for those looking for long-term solutions.

6. Identify & Retain High-Value Customers

Have you heard of the 80/20 rule, also known as the Pareto Principle? This principle suggests that 80% of your effects come from 20% of your causes. In business terms, it often translates to 80% of your revenue coming from 20% of your customers. Focus on retaining high-value customers to maximize revenue and profitability. You can implement targeted retention efforts and reduce churn by identifying and prioritizing these customers. Here are some ways to make it happen:

- Monitor Customer Lifetime Value (CLTV): Determine the long-term value of each customer to prioritize efforts and resources effectively. This analysis helps you understand the potential revenue each customer can generate over their entire relationship with your business.

- Implement Loyalty Programs: A well-designed loyalty program can reward repeat customers and encourage long-term engagement. These programs can include points systems, exclusive discounts, and special perks, fostering a sense of belonging and incentivizing customers to remain loyal.

Image Source: Omnisend.com

- Share Personalized Offers: Provide exclusive deals and benefits to high-value customers to enhance their loyalty and satisfaction. Personalized offers make customers feel valued and appreciated, increasing their likelihood of staying with your business.

8. Analyze Metrics

Regularly monitoring and analyzing churn metrics is crucial for understanding customer behavior and measuring the effectiveness of retention strategies. Follow these steps to track and report on customer churn metrics:

- Monitor Key Metrics: Track churn rate, customer value, customer value, and other relevant metrics to understand and manage customer retention effectively. These metrics provide insights into customer behavior and the financial impact of churn.

- Make Data-Driven Decisions: Use data to identify trends and inform churn reduction strategies, enabling you to address issues and improve customer satisfaction proactively. Data-driven decisions help tailor solutions that directly target the root causes of churn.

- Regular Reporting: Provide regular updates on churn performance to key stakeholders to ensure everyone is aware of progress and challenges. Regular reporting helps maintain focus on retention goals and facilitates timely interventions.

How to Monitor Churn Over Time

Monitoring churn over time involves a systematic approach to tracking, analyzing, and acting on customer retention data. Here’s how you can do it:

1. Define Your Churn Metric

- Decide whether you’re tracking customer churn (number of customers lost) or revenue churn (revenue lost due to customer departures).

- Ensure the metric aligns with your business goals.

2. Set a Time Frame

- Monitor churn over specific periods, such as monthly, quarterly, or annually, to identify trends.

- Compare the churn rate for consistent intervals to observe patterns.

3. Collect Data Regularly

- Use your CRM, AI help desk system, or analytics tools to collect data on customer cancellations, feedback, or accounts lost.

- Ensure the data is accurate and up-to-date.

4. Analyze Churn Rate

- Use this formula: Churn Rate = (Customers Lost During a Period/Total Customers at the Start of the Period) ×100

- Compare this rate across different periods to detect increases or decreases.

5. Segment Your Customers

- Break down churn data by customer demographics, product usage, or subscription plans.

- Understand which segments have higher churn and why.

6. Use Dashboards and Alerts

- Set up automated dashboards or reports to track churn rate trends in real-time.

- Use alerts to notify you of significant changes or anomalies.

7. Track Related Metrics

- Monitor supporting metrics like customer satisfaction (CSAT), Net Promoter Score (NPS), and customer lifetime value (CLV) to understand churn triggers.

- Keep an eye on product usage patterns to identify behaviors that may predict customer churn.

8. Regularly Review and Act

- Schedule periodic reviews to discuss churn insights with your team.

- Implement targeted retention strategies, such as improving customer service, offering loyalty programs, or adjusting pricing.

You can proactively address issues and improve customer retention by consistently tracking and analyzing churn.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

Customer Churn Analysis & Measurement

Understanding and measuring customer churn is essential for identifying pain points and implementing effective retention strategies. Businesses can leverage various tools and techniques to gain actionable insights into customer behavior and preferences. Here’s how you can approach churn analysis and measurement:

Operational and Experience Insights

Analyze operational data, such as service downtimes, response times, and product usage, to identify friction points that contribute to churn. Combine this with customer experience metrics to get a complete picture.

Conversation Analytics

Leverage AI and natural language processing (NLP) to analyze customer interactions across channels. Identify recurring issues, tone shifts, or dissatisfaction patterns that may signal churn risks.

Relational Feedback

Gather feedback on the overall relationship between the customer and your business through tools like Net Promoter Score (NPS) surveys. This provides insights into loyalty and areas needing improvement.

Transactional Experience Measurement

Measure specific touchpoints like a purchase, support ticket resolution, or subscription renewal. This helps identify where transactional experiences might lead to dissatisfaction or disengagement.

Key Experience Measurement Throughout the Customer Journey

Map and measure critical moments in the customer journey, from onboarding to renewal, to pinpoint where customers drop off. This enables targeted interventions to enhance these experiences.

Competition Analysis

Analyze how your offerings compare to competitors in terms of features, pricing, and customer satisfaction. Understanding why customers switch to competitors can inform retention strategies.

Customer Segment Analysis

Segment customers based on demographics, behavior, or revenue contribution to identify groups with higher churn rates. Tailor retention efforts based on customer segmentation to address specific needs.

By combining these approaches, businesses can proactively identify churn risks and implement strategies to retain customers and foster loyalty.

Choosing a Monthly, Quarterly, or Annual Churn Rate Calculation

Choosing between monthly, quarterly, or annual churn rate calculations depends on your business model, customer base, and the insights you need:

1. Monthly Churn Rate

- Best For: Companies with short contract lengths (e.g., B2C SaaS or monthly subscription plans).

- Why: Offers real-time insights into retention trends and helps address issues quickly.

- Example: Streaming services or fitness apps.

2. Quarterly Churn Rate

- Best For: Businesses balancing short-term and long-term contracts or seasonal fluctuations.

- Why: Smooths out monthly variations and gives a broader view while still being actionable.

- Example: Mid-size SaaS companies with quarterly pricing plans.

3. Annual Churn Rate

- Best For: Companies with long-term contracts (e.g., B2B SaaS or enterprise clients).

- Why: Captures long-term retention trends, offering a holistic view of customer attrition.

- Example: CRM software or enterprise IT solutions.

Reduce Customer Churn & Create an Army of Loyal Customers

Customer churn is inevitable. You will always have close competitors who offer better products or lucrative pricing and take your valuable customers away.

However, the good news is that you can always take the right steps at the right time to prevent churn. As a best practice, ensure smooth customer onboarding and add value at every stage of the customer journey. Continuously improve your products and services and analyze the right metrics to identify at-risk customers.

If you wish to retain more customers with automated support, you can try ProProfs Help Desk. With this cloud-based ticketing system, you can centralize issues from multiple channels, leverage AI for faster responses, and identify improvement areas with CSAT surveys. As your customers get round-the-clock assistance, you can finally prevent churn and boost customer satisfaction.

Customer Churn: FAQs

What is the difference between churn rate vs. growth rate?

The churn rate measures the percentage of customers leaving, while the growth rate reflects the percentage of new customers acquired or revenue gained. Churn focuses on losses, while growth tracks expansion. Together, they give a complete picture of business health.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

We'd love your feedback!

We'd love your feedback! Thanks for your feedback!

Thanks for your feedback!